In celebration of its numerous accomplishments and milestones this past year, and to give a small preview of what its customers can expect in 2022, Union Bank of the Philippines (UnionBank) held another iteration of its long-running virtual media roundtable series E-TalkTales last December 15.

During the virtual event, UnionBank Senior Executive Vice President, Chief Technology and Operations Officer, and Chief Transformation Officer Henry Aguda talked about some of the Bank's achievements for the year, while the Co-Founder and CEO of UnionBank's digital-native banking arm UnionDigital, Arvie de Vera, talked about the role that the newly formed digital bank will play in UnionBank's digital transformation journey going forward.

Aguda began the discussion by recounting how UnionBank's digital transformation journey has enabled it to brave 2020 and the equally challenging 2021. "The pandemic created this shift to digital, which we now refer to as the “new digital normal”. We changed the way we live, the way we travel, the way we interact with one another, and basically we've changed forever in terms of how we transact in the financial sector."

"But even before the pandemic, UnionBank already had this forward-looking view that digital is the way for us to move forward, and when the pandemic hit, not only did we survive, but I'm happy to say that the Bank actually thrived," according to Aguda.

He then highlighted the top 10 most notable achievements of UnionBank in 2021. These include being the only publicly listed Philippine bank to be granted a license to operate a digital-native bank; the successful groundbreaking of the UnionBank Innovation Campus, the country's first-ever learning institution focused on digital innovation; and having 21 patents for its innovative offers already approved and 18 more on the way.

Other notable achievements include the integration of Instapay 2.0 into its digital banking platform; the successful launch of the UnionBank SME Banking App; the launch of wealth management educational campaigns including the NextGen Academy; significant user growths for UBX’s platforms SeekCap, Bux, and Sentro; and the significant increase in its customer base to almost 10 million to date, from just nearly 7 million as of end-2020.

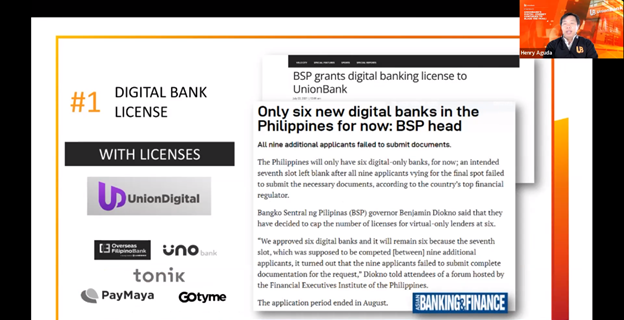

Meanwhile, de Vera provided a quick introduction to UnionDigital. UnionDigital is one of only six financial institutions in the Philippines that have officially been granted digital banking licenses by the Bangko Central ng Pilipinas to date. As UnionBank's digital banking arm, UnionDigital will focus on delivering banking and financial services to underserved sectors which the parent bank is not able to optimally cater to.

"While UnionDigital aims to empower the country's digital economy, we also aim to elevate it by bringing trust and governance into the space. We embrace innovation like a fintech, but offer all the powers, experience, and track record of a fully regulated bank,” de Vera said.

“At the heart of our work will always be the desire to provide our customers with what they want and what they need, while ensuring that they have what they need in terms of security, compliance with regulation, and proper governance," de Vera added.

In terms of what customers can expect from the Bank and its subsidiaries in 2022, some of the things that Aguda and de Vera gave a sneak preview of were the Bank's possible foray into non-fungible tokens (NFTs), several new solutions aimed at helping workers in the thriving gig economy through EON, and participating in the growing interest and opportunities relating to the metaverse, just to name a few.

UnionBank Chief Marketing Officer Albert Cuadrante capped off the event with a promise that the Bank will continue to do even better in 2022 in terms of delivering great customer experience across channels and platforms. He also reiterated that "UnionBank’s goal is not just to help people survive, but to actually enable them to thrive in this new environment through the latest financial technologies; staying true to our commitment to “Tech-up Pilipinas!”

"I hope you are as eager as I am to welcome 2022. What I can promise you is that what you heard today is just the tip of the iceberg. There’s a lot more exciting news you can look forward to from UnionBank," Cuadrante concluded.