January 18, 2024

Smart partners with UnionBank to reward subscribers with up to P5,000 Welcome Gift

March 11, 2023

Here’s why you should upgrade to the UnionBank SSS UMID Pay Card

January 16, 2023

Reminder to qualified UMID applicants: Upgrade to UnionBank SSS UMID ATM Pay Card today

SSS members with pending UMID ID releases may avail of free upgrade online

Union Bank of the Philippines (UnionBank) is reminding members of

the Social Security System (SSS) who are qualified for a free upgrade to the

UnionBank SSS UMID ATM Pay Card to avail of the offer now so they can enjoy an

easy and convenient way to receive their SSS proceeds.

Announced a few months ago, the UnionBank SSS UMID ATM Pay Card is a

government-issued ID card and fully functional ATM card that is linked to a

UnionBank savings account, where SSS members can receive the proceeds of their

benefits, loans, and refunds. The savings account doesn't require maintaining

balance.

SSS members who are registered on My.SSS and have applied for the

standard UMID card but have not received it yet may avail of the UnionBank SSS

UMID ATM Pay Card upgrade for free. To let them know about the upgrade option,

SSS also sent invitations to qualified members via email, so they may want to

check their email. The upgrade will be available to all SSS members applying

for the UMID card eventually.

Qualified members may upgrade their card by logging in to their

My.SSS account, or register if they haven’t yet. They will then need to go to

the "E-Services" tab, access the "Data Sharing Consent for UMID

Pay Card" option, and give their consent to share their information with

UnionBank.

Next, they must download the UnionBank Online app, which is

available on the Google Play Store, Apple App Store, and Huawei AppGallery. They

can also visit https://www.unionbankph.com/unionbankonline

and or scan the download QR code.

On the app, they need to select the "Open an Account"

option, choose "Government ID," click "SSS UMID Pay Card

Account," and then click “Agree to the Terms & Conditions and

Data Privacy Consent” to continue. After making sure that their SSS

information is updated and correct, they will need to complete the form to open

their savings account. More details are available at https://www.unionbankph.com/sss-umid.

Upgrading to the UnionBank SSS UMID ATM Pay Card comes with a few

perks. Once the free upgrade is completed, funding the account with a minimum

of PHP1,000 entitles the owner to a free Jollibee eGC worth P200 and a chance

to win a brand-new Mitsubishi Xpander GLS sponsored by UnionBank. Account

holders must fund their account on or before Feb 28, 2023 to enjoy these perks.

Because the card is linked to a UnionBank account, users will be

able to enjoy fully-featured ATM transactions, as well as digital banking

services and advanced features like financial goal setting and payment requests

via the UnionBank Online app.

UnionBank has been a long-time partner of the government in the

issuance of two-in-one ID and pay cards that have benefited countless Filipinos

over the years, and the new UnionBank SSS UMID ATM Pay Card is just one of the

many innovative offers that have come from its partnerships with government

agencies like the SSS and the Government Service Insurance System (GSIS), to

name a few.

To learn more about the UnionBank SSS UMID ATM Pay Card, visit https://www.unionbankph.com/sss-umid.

December 30, 2022

BENCH Techs-up with UnionBank: Digital payments enhanced in 800+ stores across the nation

December 10, 2022

UnionBank Techs Up with Globe Fleet Management Solutions

November 5, 2022

UnionDigital Banks 1.73-M Customers in Four Months, Onboards PDAX as First Corporate Account Customer

October 4, 2022

UnionBank Innovation Festival 2022 brings together key tech industry players under one roof

September 22, 2022

QR ng AUB, GCash, Metrobank, and Unionbank? I-Maya na yan!

February 20, 2022

UnionBank joins PSE Investment Forum 2022, talks crypto as future of banking, finance

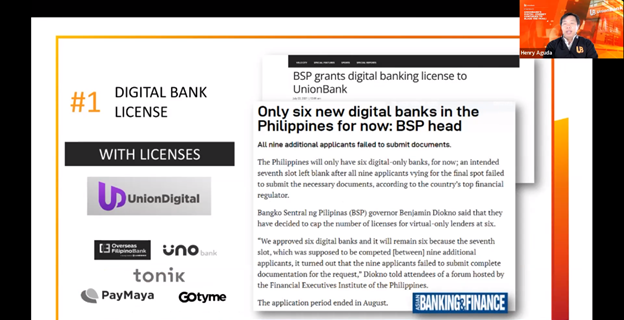

Union Bank of the Philippines (UnionBank) Senior Executive Vice President, Chief Technology and Operations Officer and Chief Transformation Officer Henry Aguda joined discussions on digital and crypto assets as the future of financial investments at the recently concluded PSE Investment Forum 2022.

As the country’s first bank to successfully carry out financial transactions through blockchain, UnionBank attests to the use of technology in banking securely and efficiently. Blockchain can thus, be applied in a wide array of use cases.

“In fact, one of the very good applications we started with early on, was how to address the problem where rural banks don't have access to one another; and to the basic banking requirements in the industry,” Aguda explained.

“We found a cheaper solution, and we gave this to the rural banks in the form of i2i, a platform that allows us to provide them a channel to interconnect with each other. And we wouldn't have been able to do that if not for blockchain, specifically because of its low-cost operations and how easy it is to program,” he added.

Asked whether blockchain-based transactions are the future of banking and finance, Aguda agreed. "If you follow trends in history, we went from gold to paper, now it's moving toward digital. So, if you go by that trend, everything is going to be digitized form of transactions. It's no longer going to be a transfer of record of value, it will be a digital transfer of value."

As to crypto being a viable investment, the UnionBank executive answered in the affirmative but expounded. "Yes, but subject to the following. First, keep it to the top 10 coins. Second, it shouldn't be above five percent of your total investible portfolio, meaning it's money that you can afford to lose. And third, do your own research," Aguda said.

To conclude his talk, Aguda reminded the attendees: "First, on blockchain technology, it's something that every company should explore. We've proven that it's useful in terms of increasing efficiency in operations, and it's easy to use. Second, as an investment instrument, (crypto or currency based on blockchain) it's in the early stages. If you want to experiment and include it in your portfolio, it's at your own risk. The regulation is still evolving, so treat it as a high-risk instrument and then explore,” Aguda said.

“Hopefully, venues like these where it is discussed, help the regulators form the right risk management framework and policies around it."

January 16, 2022

Priority for AI implementation should be trust, not regulation – UnionBank data science, AI expert

Dr. David Hardoon, UnionBank Senior Adviser for Data & Artificial Intelligence, was recently invited to discuss his views on data science and artificial intelligence (AI) at an EFMA Sustainability & Regulation Community Best Practice Forum.

January 14, 2022

UnionBank clients can now seamlessly do direct cash-in to their Shopee and Lazada wallets!

January 6, 2022

Former Citibank PH country manager confident with Citi’s choice of UnionBank

December 19, 2021

UnionBank attributes DX success, innovation in part to BSP's openness

Achievements, future projects take the spotlight at UnionBank’s E-TalkTales year-ender event

December 18, 2021

UnionBank CTO recognized as one of the biggest names in Data in the world

December 10, 2021

UnionBank wins big at the 2021 Asian Technology Excellence Awards

November 19, 2021

UnionBank UPAY for MSME: Helping level the playing field for the country’s growing number of MSMEs

UnionBank recently held the 12th E-Media TalkTales as the Philippines’ foremost bank for MSMES discussed the critical role of digitizing payments in the country’s fast-evolving market.

To help micro, small, and medium enterprises (MSMEs) in the country capitalize on this growing trend, Union Bank of the Philippines (UnionBank), the region’s digital trailblazer and the country’s foremost bank for MSMEs, has launched a groundbreaking feature that will make e-payments easier and secure not only for customers but also for MSMEs—the new UPAY for MSME.

This was

unveiled at the Bank's 12th E-TalkTales media event, wherein UnionBank Vice

President and MSME Segment Head Jaypee Soliman, and UnionBank Merchant

Acquiring and Payment Gateway Head Gerry Austria led discussions on the

critical role of digitizing payments in the country's fast evolving market.

Soliman began the discussions by talking about the state of digital

payments in the country, citing the significant growth in the number of

Filipinos who utilize these payment solutions. This is an indication that Filipinos

are now more open to the idea of becoming a cash-lite society.

“This shows how

the consumers are now transacting digitally. They are ready. They are there. The

number of Filipinos having e-wallets and bank accounts continue to grow. But

the question is, are the MSMEs ready to accept digital payments?"

This is where UPAY comes in. UPAY is a groundbreaking digital

payments solution designed to make acceptance of multiple payment options

accessible to MSMEs. It offers a fully integrated, single platform payment

collection complete with other features that can make inbound payments easier

for entrepreneurs, including the option to generate payment links with multiple

collection channels, and the option to generate InstaPay QRPH for digital and

physical channels.

"UPAY for MSMEs is a payment gateway that is embedded in our

MSME Business Banking App. Businesses of all sizes and types now have the power

to generate payment links, request payments, send it to their customers and

provide multiple payment options, all these reconciled and credited to a single

UnionBank account," Soliman said.

What makes UPAY

convenient for accepting payments is that customers can choose their preferred

payment channel either via Unionbank Online, InstaPay, Other Digital Wallets,

Credit/Debit Cards and even over-the-counter through UnionBank’s expansive

network of partner channels nationwide.

"When we conceptualized UPAY for MSMEs, we wanted to do away

with all the different hassles that the merchant is experiencing to set up his

payments, one of which is having to connect to a point-of-sale system, having

to have different devices, having to have to download different apps,"

Austria said.

"Second, it's the efficiency in doing business. You don't need

to be in your physical store to actually have a customer pay you. You can

actually be vacationing somewhere else and someone wants to buy a product that

they saw through your post on Instagram or Facebook. You can actually just

create a payment link and send it to that customer, so it's very convenient for

both the merchant and the customer," Austria added.

Through the new feature, UnionBank wants to level the playing field

for MSMEs by making the feature accessible to them, which was previously only

available to the bigger merchants as part of enterprise platforms that are too

technologically demanding and expensive for smaller players.

For more information about the company and this article,

please visit

May 25, 2021

UnionBank doubles down on digital, invests in San Pedro Innovation Campus

Union Bank of the Philippines (UnionBank) is set to break ground on its Innovation Campus in Laguna on May 26 in a virtual ceremony. The Campus is a first in the Philippine banking industry and will integrate UnionBank’s institutes on Data Science and Artificial Intelligence, Blockchain, as well as its digital bank EON in one roof.

Located in a one-hectare real property development in San Pedro, Laguna, the five-story building will be the hub for research and development to further boost the Bank’s digital capabilities by creating solutions for the future of banking, fintech as well as other industries.

“The UnionBank Innovation Campus is a testament to the commitment of Management and the Board to innovation as a major strategic thrust of the Bank,” said UnionBank President and CEO Edwin R. Bautista.

Set as the peak of its digital transformation that started five years ago, the Campus provides a digital native environment which will allow research and discovery of digital initiatives that will amplify the Bank’s thrust to Tech Up Pilipinas and enable inclusive prosperity making sure that no one gets left behind.

“I am really looking forward to inviting our customers and our partners to a place where we can showcase the great things we are doing and share what we have learned, so that the Filipino companies can be globally competitive in this new digital age as we continue our efforts to ‘Tech Up Pilipinas’ while pioneering innovations for a better world,” Bautista said

.jpg)